Is Flex Space Investing the Next Big Opportunity in Alternative Real Estate?

The world of commercial real estate is shifting, and one niche is starting to make headlines: flex space investing.

From major corporate leases to global expansion of flex operators, 2025 is shaping up to be a defining year for this emerging asset class. At QC Capital, we specialize in alternative investments that generate passive income—and while we remain focused on our core real estate strategies, we believe staying informed about flex space trends is essential for today’s passive investor.

🚨 Major Flex Space News in 2025

Here’s why flex space is at the center of recent industry headlines:

Deloitte signs major flexible office lease: In a bold move, Deloitte secured 800,000 sq. ft. at Hudson Yards in Manhattan. The space is built with adaptability in mind—signaling that even enterprise companies want flexible, modern workspaces.

WOTSO Property expands suburban footprint: The Australian flex space operator announced new openings in regional markets, citing rising demand from hybrid workers and small business owners.

FlexSpace Nation launches in Las Vegas: This new platform aims to unite investors, developers, and operators interested in flex real estate, further legitimizing the sector.

These developments highlight a larger trend: flex space is evolving from a trend into a strategic investment category.

🧠 What Passive Investors Should Know About Flex Space Investing

Even if you’re not investing in flex real estate directly, understanding this space can help shape a more diversified portfolio.

1. Flex Space Supports the Hybrid Work Revolution

With hybrid work now the norm, companies and entrepreneurs are turning to short-term leases and modular workspaces that allow them to scale without long-term commitments. Flex space fills this demand with built-in infrastructure and plug-and-play options.

2. Tenant Diversity Increases Stability

A flex space may include e-commerce hubs, creative studios, wellness clinics, and small logistics operations, all under one roof. This diverse tenant mix reduces vacancy risk and supports more stable cash flow.

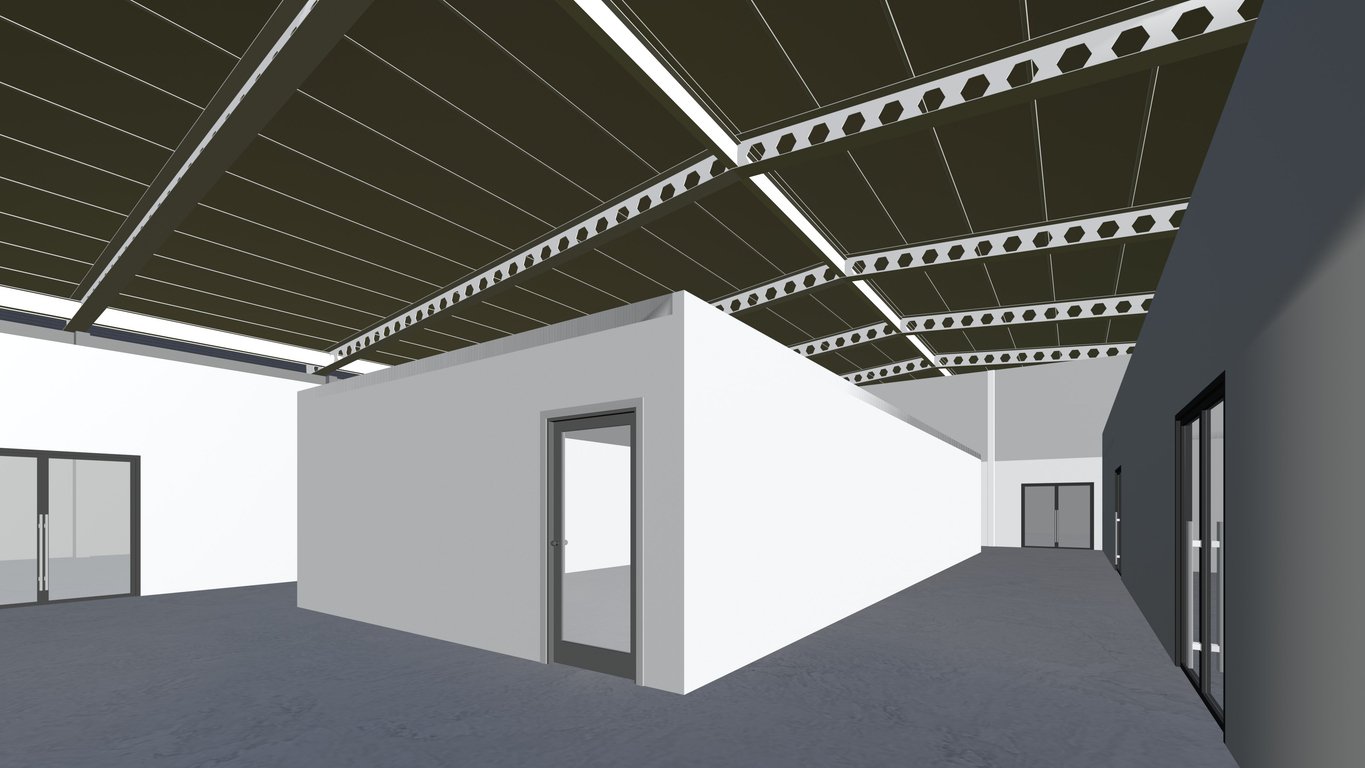

3. Flex Properties Revitalize Underused Buildings

One reason flex space investing is trending is its ability to transform underutilized office or retail assets into modern, income-producing properties, especially in suburban and secondary markets.

4. PropTech Is Driving Efficiency

Smart technologies, like app-based bookings, AI-powered systems, and automated access, are making flex properties more efficient and scalable. Just like in our car wash investments, tech is a key driver of ROI.

🔍 Where QC Capital Stands on Flex Space Investing

At QC Capital, we help investors gain access to high-performing alternative real estate investments like express car washes. While we are not offering flex space investments at this time, we are closely following market developments and studying how this asset class is evolving.

Our focus is on providing market insights that help you make informed decisions as a passive investor, and right now, flex space is one of the most talked-about sectors in alternative real estate.

📈 Flex Space Investing: A Trend Worth Watching

With its combination of adaptive use, stable income potential, and alignment with modern work culture, flex space investing offers a compelling story for passive investors exploring new real estate opportunities.

Want to stay ahead of the curve as this trend continues to unfold?

👉 Reach out to us at [email protected] for more information and for weekly updates on market trends, emerging asset classes, and passive income opportunities.